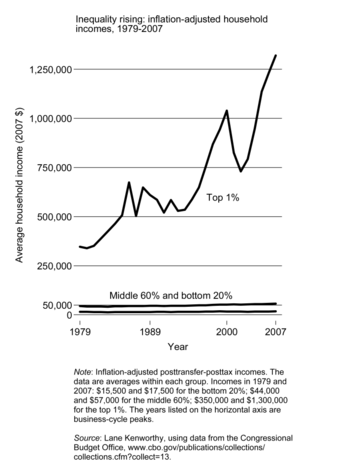

We have so much that is existential to worry about in the world outside our borders that it almost seems trivial to concern oneself with our economy and where it is leading us. I say "leading us" because no matter what policy concerns are announced, the trend toward towering wealth in the hands of a very few--and perhaps most importantly the manifestation of that wealth in the form of political control of the nation as a whole that derives from that concentration of wealth--seems ineluctable. And the longer it is allowed to persist the more at risk our way of life is, not just in the material sense, but more importantly in the sense of the ethos to which we at least give lip service. In an article in the New York Times several days ago, Janet Yellen, the new chairwoman of the Federal Reserve, noted that income inequality is "one of the most disturbing trends facing the nation." The Times observed that during the 2010-2013 "recovery" from the economic debacle of 2007-08, which financial catastrophe itself was a function of this very phenomenon and the power--and alarming respectability--of greed in our society today, the most affluent 10% of our society experienced an increase in personal income of 10%. Concomitantly, and I say concomitantly because there is a cause and effect relationship at work, the bottom 20% of income earners lost 8% of their earnings to the migration of capital into the hands of the aforementioned top 10% and others just below them. And that fact is manifested in the relative sizes of the estates of those two demographic groups. As the wealth of the top 10% of earners increased by over 3%, that of the bottom 20% lost an astounding 21% to the economic shift, and the new wealth of the wealthy certainly did come from those at the bottom of our economy as the extent of overall wealth in the nation didn't increase at all; it was merely redistributed from bottom to top. What most people, even those at the top of our economic pyramid, fail to recognize is that this trend is the death rattle of the dieing of the golden goose that got us all here.

I've said this all before, but I have never before seen it so clearly stated by a national policy maker rather than by someone who is part of the radical fringe on our political spectrum. Alarmist as it sounds, it now seems eminently realistic to raise that alarm since the chairwoman of our central banking systems active arm has expressed her concern. The reason is that when income and wealth accrete at these lofty levels, it reposes in the hands of people who will never spend the vast majority of it, thus taking it out of circulation and allowing our upward spiral of general economic well-being to reverse itself. It is consumer spending that fuels a market, capitalistic economy, and restricting such consumption prevents money from recirculating in the form of new jobs needed to meet demand. Unemployment thus resists efforts to address it, and the few jobs that are created are not adequate in terms of the earnings they represent to keep the flow of wealth moving. The next step in that progression is deflation, which Yellen and others have referred to obliquely, but deflation was the mechanism by which the depression crushed the American economy and the spirits of tens of millions, and deflation will do the same thing to us again if it recurs. The current trend is just the continuation of a long term trend that resulted in collection of 30.5% of all income by the top 3% of families in 2013, up from 27.7% in 2010, as reported by The Times that day. Further indications of the prospect of deflation is the way in which average families have changed their spending habits. Average family debt has declined to 105% of annual income in 2013 from 125% in 2010. At first blush that seems a positive thing as less debt makes the average family commensurately less vulnerably financially. But in conjunction with the trends in income and overall wealth, it suggests that people feel more vulnerable that in the past, and in consequence of that tenuous state of affairs that the majority of Americans sense despite the claims that we have been experiencing a recovery is that there has been no recovery in their houses, and thus they are staunching themselves against what they anticipate will be an ominous future.

Unfortunately, if and when the day of financial reckoning comes, those already at the top will be easily able to weather the storm, even if it lasts a decade as the depression did. On the other hand, those of us below that elite level...as many as 80%-90% of us depending on how severe the cataclysm is and whether we can elect another egalitarian like FDR...may not be so lucky. The rich will suffer losses, but they will not have immediate effect on their daily lives. You and I however, will experience every painful month of it. So, since there is no real incentive for the super-rich to rethink their acquisitiveness, we are on our own, and the only real tool we have is the polls.

The elections in November are important, but as indicated by the tendency of Americans to be more apathetic during these mid-term elections, they are not critical to our long-term future the way that presidential election cycles are. My hope is that there will emerge over the next two years a political movement among mainstream politicians that advocates not just recognizing the impending disaster but also advocates policies and practices--including but not limited to tax policy, labor rights, constraint on hereditary wealth, statutory mandates in the form of tariffs that prevent corporations from hording profits abroad rather than paying taxes on them, and other highly directed strategies--intended to reverse the trend toward putting excess wealth in the hands of those who run our economy and promoting its flow into the hands of the people who do the work instead. Understand that I am not opposed to capitalism in any way. It seems the most compassionate form of governance, and it allows at the same time for variegation of circumstances as deserved depending on initiative, talent and application of oneself to the labor that is his or her contribution to the system overall, which is only fair. But today, we have seen that principle run amok, and we are creating a class of patrician executives and financiers who take more than they produce or merit just because they can. A country that pays the chief executive of a football league $44 million per year while it doesn't demand that its legislature renew unemployment compensation or some other form of welfare benefit for those stricken by our economic dysfunction, needs ethical reorientation in the form of more enlightened government. I plan to vote with that in mind.

Your friend,

Mike

Leave a comment